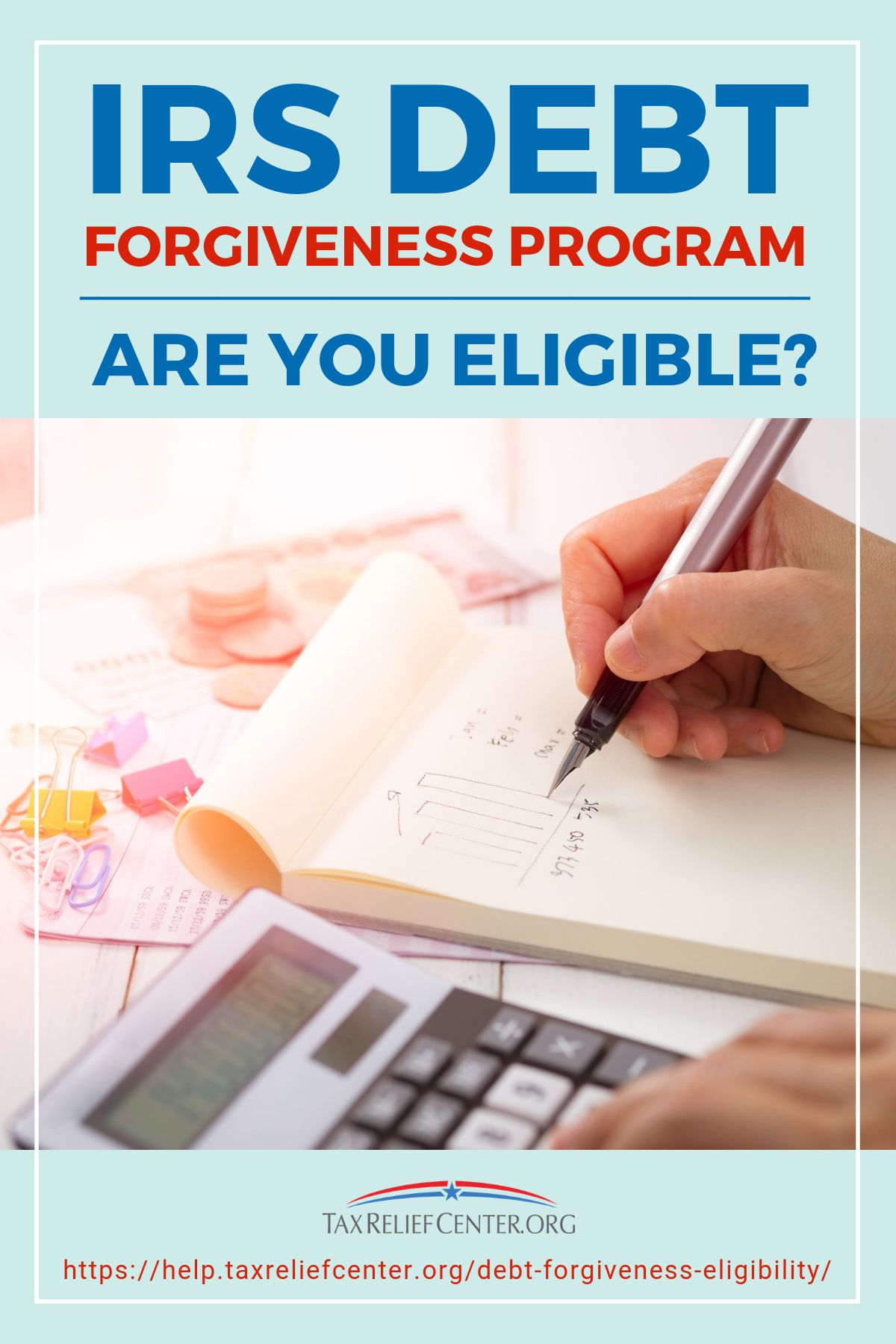

tax payment forgiveness program

City of New Orleans Offers Amnesty Late Fee Forgiveness Program for Residents and Taxpayers. However if we have a valid reason for not making the payment there are a few IRS tax debt forgiveness programs.

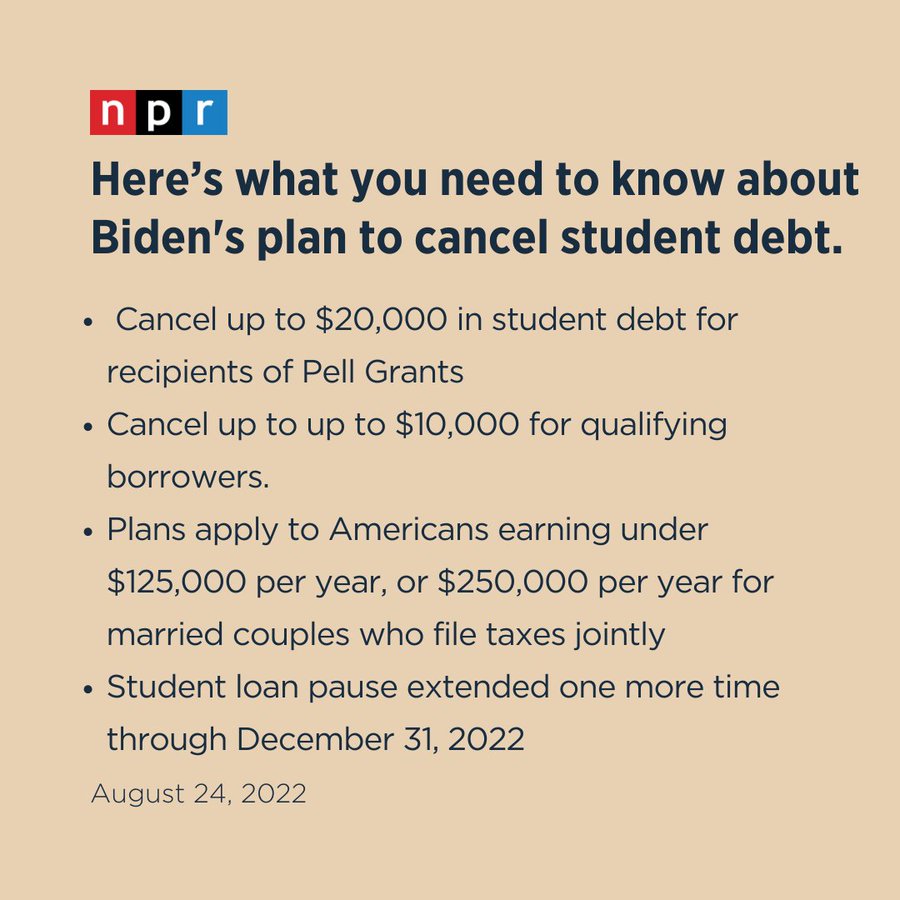

Biden To Cancel Up To 10k In Student Loan Debt For Borrowers Making Under 125k Npr

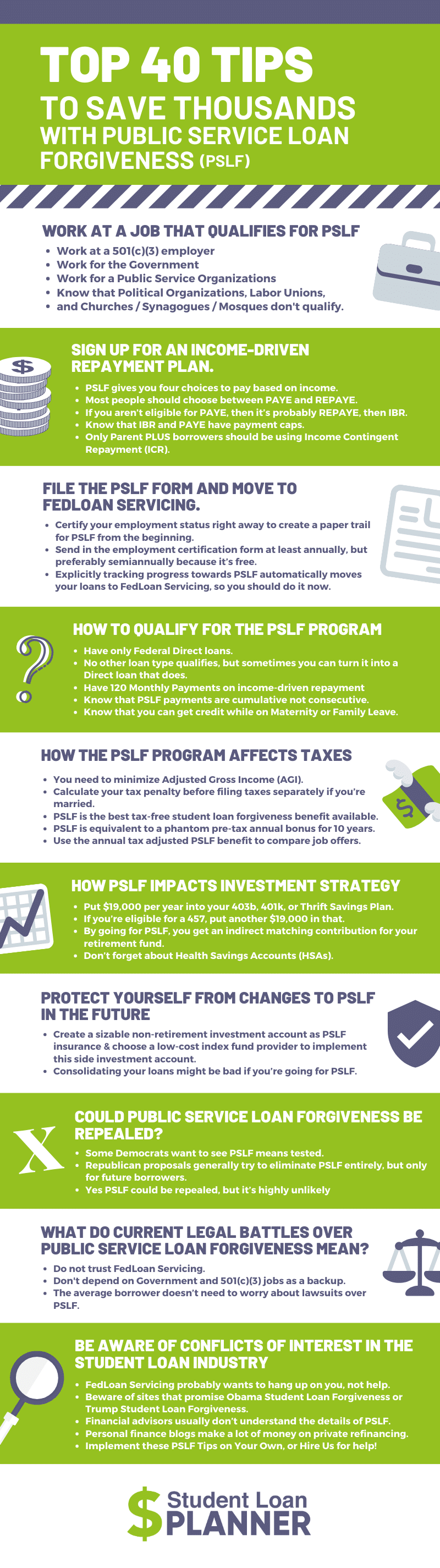

Forgives your loan balance after 10 years of.

. This is a tax debt forgiveness for. Earn less than 100001 200001 for joint taxpayers Owe less than 50000 at the time of application. IRS debt relief is for those with a debt of 50000 or less.

A total income below 100000 or 200000 for married couples A recent drop in income of over 25 for self-employed individuals. Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal Earned Income Tax Credit program. Anyone can be eligible to find tax relief with an IRS debt forgiveness program no matter how long or how much you owe for your tax bill.

See More This Guy Resolved. No tax debts for the. The IRS Fresh Start Program allows for tax forgiveness.

The national hotline provides free 247 crisis counseling for people who are experiencing. Some of the biggest perks include. Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married couples.

To qualify for partial or total tax forgiveness through this program you must meet all of the following conditions. Mental health - Call or text the Disaster Distress Helpline at 1-800-985-5990. Then you have to prove to the IRS that you dont have the.

First-time penalty abatement is another one-time forgiveness program that allows the IRS to waive all fines and penalties you owe. For more information visit the Internal Revenue Services Web site. For example in Pennsylvania a.

State Tax Forgiveness. Agree to a direct payment installment forgiveness. The Mayors Office and Department of Finance is offering a late fee.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. States also offer tax forgiveness based on personal income standards. Raises the amount of whats considered non-discretionary income meaning those amounts are off the table for repayment.

You can also apply for the IRS. One IRS tax forgiveness program also known as an offer in compromise comes with a long list of benefits. In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes.

These standards vary from state to state. Provides a reduction in tax liability and. You filed a joint return which has an understatement of tax due because.

A total tax debt balance of 50000 or below. 2 days agoIf your state charges a tax rate of 5 for example expect to pay about 500 in taxes on 10000 in loan forgiveness or 1000 on 20000 in loan forgiveness. People who are missing stimulus payments should review the information on the Recovery Rebate Credit page to determine their eligibility to claim the credit for tax year 2020 or 2021.

The qualification requirements are.

Irs Tax Debt Forgiveness Programs 2016 Youtube

Student Loans Who Can Pay Taxes On Forgiven Debt Marca

Tax Debt Relief Irs Programs Signs Of A Scam

What Is Irs Tax Debt Relief Program Do You Qualify For It By Lucas Bell Issuu

How To Defer Your 2020 Tax Payments Bench Accounting

Tax Debt Relief Real Help Or Just A Scam Credit Karma

Student Loans Here S Who May Pay Taxes On Forgiven Student Debt Cnet

Irs Debt Forgiveness Program Are You Eligible Tax Relief Center

What Is The Irs Debt Forgiveness Program Tax Defense Network

4 Loan Forgiveness Programs For Teachers Federal Student Aid

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Tax Debt Relief What Is Tax Debt Relief Paying Off Tax Debt

Best Tax Relief Companies Top 6 Tax Debt Resolution Services Of 2022

Irs Payment Plan Everything You Need To Know Community Tax

Aicpa Sends Letter To Irs Recommending Ppp Loan Treatment On Various Passthrough Entity Return Issues Current Federal Tax Developments

Tax Debt Relief Resolve Your Debt With The Irs Bankrate

Cra Tax Debt Forgiveness Tax Forgiveness Programs Kalfa Law

Public Service Loan Forgiveness 40 Tips To Save Thousands

What 10 000 In Student Loan Forgiveness Means For Your Tax Bill Fortune